Cpappa27

Well-Known Member

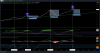

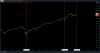

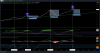

I was doing some charting this morning and thought I would share this chart I made with you guys. In the chart as you can see the Real Residential Property Prices in the USA topped out in January of 2022 and have been on a decline since. Ive noticed houses I was looking at just a year ago, the prices are cut by 50% or more in some cases. Now what will cause this sort of drop in home prices one can speculate, and I have my own theories on that but regardless it looks like houses are about to get real cheap in the coming years.

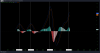

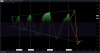

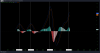

How far it will correct is unknown at this point, but as you can see the last significant drop was from 2006 to 2011 almost 40%. This correction may go all the way down to the trend line before another massive spike in home prices in 5 years or so. RSI (Relative Strength Index) was overbought and had peaked back in January 2022, then broke the moving average to the downside and has a long way to go before reaching oversold again for the reversal back to the upside. Also the MACD (Moving Average Convergence Divergence) has a fresh curl and is pointed straight down about to break its moving average which is very bearish. Stochastic RSI is also straight down. All indicators are pointing to a massive correction that has already started. Also there is major bearish divergence between the chart price movement and the RSI + Momentum from the 2006 high to the 2022 high. When theres bearish divergence that strong the drop is imminent. As you can see the last bearish divergence was back in 1979-1989 tops. That bearish divergence was on the MACD, and it wasn't very strong but strong enough for a 15% dip to the trend line.

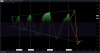

There is one thing that makes me think that there is a slight chance that the housing prices could go back up for an even higher high before the correction is the RSI. If you notice the RSI has been following this broadening wedge or megaphone structure. Its possible that the price could make one more move up in a blowoff top before a massive swift correction. I dont think this is likely but it is a possibility. All of this is just my opinion and not financial advice. Good luck out there, lots of money to be made in the next 10 years.

How far it will correct is unknown at this point, but as you can see the last significant drop was from 2006 to 2011 almost 40%. This correction may go all the way down to the trend line before another massive spike in home prices in 5 years or so. RSI (Relative Strength Index) was overbought and had peaked back in January 2022, then broke the moving average to the downside and has a long way to go before reaching oversold again for the reversal back to the upside. Also the MACD (Moving Average Convergence Divergence) has a fresh curl and is pointed straight down about to break its moving average which is very bearish. Stochastic RSI is also straight down. All indicators are pointing to a massive correction that has already started. Also there is major bearish divergence between the chart price movement and the RSI + Momentum from the 2006 high to the 2022 high. When theres bearish divergence that strong the drop is imminent. As you can see the last bearish divergence was back in 1979-1989 tops. That bearish divergence was on the MACD, and it wasn't very strong but strong enough for a 15% dip to the trend line.

There is one thing that makes me think that there is a slight chance that the housing prices could go back up for an even higher high before the correction is the RSI. If you notice the RSI has been following this broadening wedge or megaphone structure. Its possible that the price could make one more move up in a blowoff top before a massive swift correction. I dont think this is likely but it is a possibility. All of this is just my opinion and not financial advice. Good luck out there, lots of money to be made in the next 10 years.