Some are more equal than others...

- Thread starter Padawanbater2

- Start date

Dr Kynes

Well-Known Member

zomeboiez make moar uh uh uh uh uh moneez zan uh uh uh uh mee!Saez was at UBC recently giving a presentation on his research with respect to Canada.

Not surprisingly, there are many similarities to the US.

Padawanbater2

Well-Known Member

zomeboiez make moar uh uh uh uh uh moneez zan uh uh uh uh mee!

Dr Kynes

Well-Known Member

your ability to make an argument is as poor as Frenchy Ver2.0.

his heavy accent, and abysmal stammering made the entire presentation unintelligible.

he could have been doing a dramatic reading of the telephone book for all the sense i could make of it.

but you cant make an argument at all, at least Frenchy Ver 2.0 gave it a shot.

heckler73

Well-Known Member

your ability to make an argument is as poor as Frenchy Ver2.0.

his heavy accent, and abysmal stammering made the entire presentation unintelligible.

he could have been doing a dramatic reading of the telephone book for all the sense i could make of it.

but you cant make an argument at all, at least Frenchy Ver 2.0 gave it a shot.

I have to agree. Saez's presentation was rather dry, and rough. It wasn't until the last few minutes where it even began to pique my interest. My greater takeaway from it was the way the uppermost layer of the income (is it even appropriate to call it that?) spectrum demonstrates where the money has gone, post-GFC.

I believe the efforts of CBs to "back stop the financial sector" has worked; it kept the ultra-wealthy from rioting in the streets of the Cayman Islands

Padawanbater2

Well-Known Member

In other words, you don't understand a word he said, so he's wrongyour ability to make an argument is as poor as Frenchy Ver2.0.

his heavy accent, and abysmal stammering made the entire presentation unintelligible.

he could have been doing a dramatic reading of the telephone book for all the sense i could make of it.

but you cant make an argument at all, at least Frenchy Ver 2.0 gave it a shot.

Like usual..

Back when the USA made just about everything for the rest of the world ( Cuz ya know we destroyed the rest of the world with our bombs), a factory could afford to pay people doing monkey jobs ( push this button every time the light goes off) more money that they were really worth. So time went on and people thought they would start factories in other nations where people were willing to work for a whole lot less than spoiled Americans. Because of legislation that opened up avenues of trade with these companies and all the tax laws that made it mighty profitable to go overseas and make widgets employing willing slave labor, rich people with capital could afford to do it, and did. Now they make it there, employing other people, and sell it back to you at a profit. So now instead of making the widgets and putting the money into our economy, we buy their widgets and give them money for their economy.

And people wonder why they aren't as well off as they once were, but the rich people with companies overseas and with the right connections in finance are richer than ever.

The politicians promised you the world was your oyster, they just didn't tell you that the pearl was the USA and that they had sold you off to the highest bidder long ago.

Perhaps if we have another world war where Asia, Russia , Europe, and Japan are all destroyed we can go back to $120,000 a year for making widgets.

And people wonder why they aren't as well off as they once were, but the rich people with companies overseas and with the right connections in finance are richer than ever.

The politicians promised you the world was your oyster, they just didn't tell you that the pearl was the USA and that they had sold you off to the highest bidder long ago.

Perhaps if we have another world war where Asia, Russia , Europe, and Japan are all destroyed we can go back to $120,000 a year for making widgets.

Padawanbater2

Well-Known Member

Offshoring jobs is part of the problem, but it's not the whole pictureBack when the USA made just about everything for the rest of the world ( Cuz ya know we destroyed the rest of the world with our bombs), a factory could afford to pay people doing monkey jobs ( push this button every time the light goes off) more money that they were really worth. So time went on and people thought they would start factories in other nations where people were willing to work for a whole lot less than spoiled Americans. Because of legislation that opened up avenues of trade with these companies and all the tax laws that made it mighty profitable to go overseas and make widgets employing willing slave labor, rich people with capital could afford to do it, and did. Now they make it there, employing other people, and sell it back to you at a profit. So now instead of making the widgets and putting the money into our economy, we buy their widgets and give them money for their economy.

And people wonder why they aren't as well off as they once were, but the rich people with companies overseas and with the right connections in finance are richer than ever.

Because you got sold down the river a long time ago by politicians that promised you the world was your oyster, they just didn't tell you that the pearl was the USA and that they had sold you off to the highest bidder long ago.

Perhaps if we have another world war where Asia, Russia , Europe, and Japan are all destroyed we can go back to $120,000 a year for making widgets.

Every metric shows wages stagnating and economic inequality increasing in 1980. This wasn't because corporations simultaneously decided to offshore their labor.

Nobody can explain that part, why does all this happen in 1980? Because Buckley v. Valeo & FNBB v. Bellotti

1980? Computer rigging of the markets. Total Project ControlOffshoring jobs is part of the problem, but it's not the whole picture

Every metric shows wages stagnating and economic inequality increasing in 1980. This wasn't because corporations simultaneously decided to offshore their labor.

Nobody can explain that part, why does all this happen in 1980? Because Buckley v. Valeo & FNBB v. Bellotti

Stephen Devaux

sheskunk

Well-Known Member

Padawanbater2

Well-Known Member

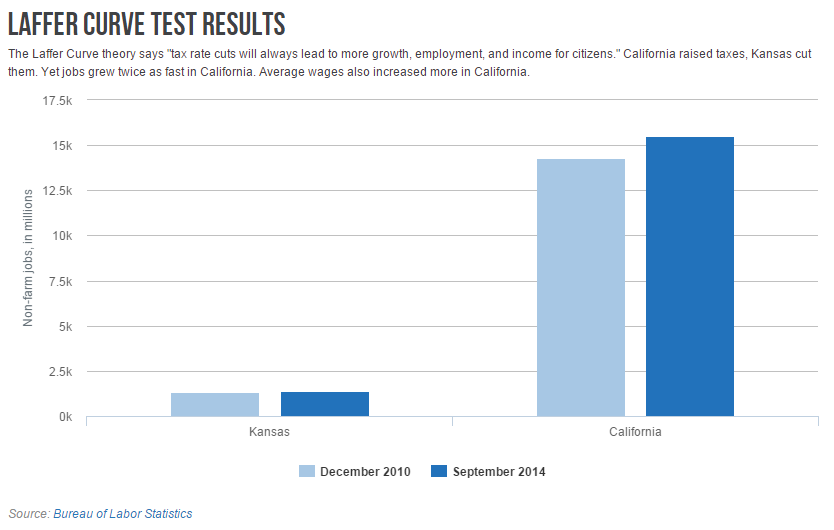

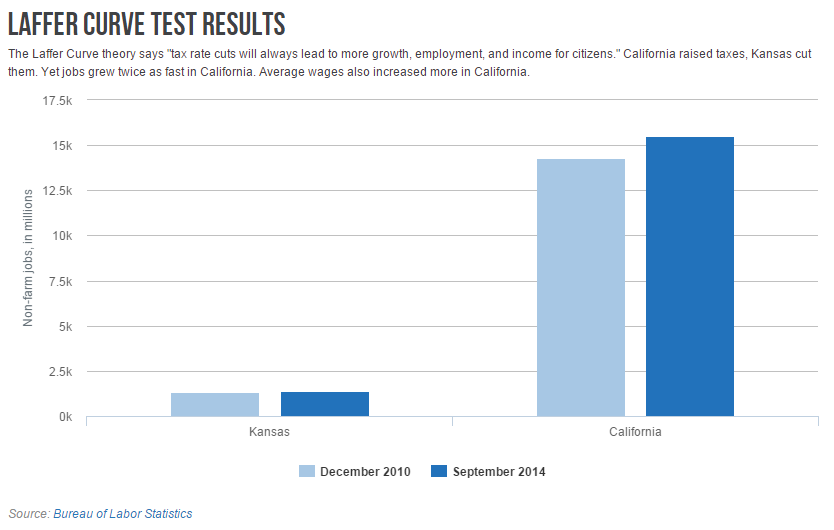

Real world contradicts right-wing tax theories

Facts over theory

Ultimately, real world results trump theory. Actual changes in the number of jobs and what they pay should be used to set policy, not ideology, assumptions and expectations.

Over a long period of time the real world results from the tax cuts in Kansas and increases in California, as well as the freezing of minimum wages in some jurisdictions while neighbors raise theirs, may change.

My expectation, however, is that the gaps will widen, with higher tax California and higher minimum wage areas doing better over time than places like Kansas that cut taxes or that froze their minimum wage. Time will tell. The important thing is that policy should follow the facts, no matter where they go.

http://america.aljazeera.com/opinions/2014/12/laffer-curve-taxcutshikeseconomics.html

Facts over theory

Ultimately, real world results trump theory. Actual changes in the number of jobs and what they pay should be used to set policy, not ideology, assumptions and expectations.

Over a long period of time the real world results from the tax cuts in Kansas and increases in California, as well as the freezing of minimum wages in some jurisdictions while neighbors raise theirs, may change.

My expectation, however, is that the gaps will widen, with higher tax California and higher minimum wage areas doing better over time than places like Kansas that cut taxes or that froze their minimum wage. Time will tell. The important thing is that policy should follow the facts, no matter where they go.

http://america.aljazeera.com/opinions/2014/12/laffer-curve-taxcutshikeseconomics.html

ginwilly

Well-Known Member

Pad, that's not what the Laffer Curve theory says at all.

The entire article starts with a premise that's a fabrication then compares apples to oranges.

Laffer talked about the sweet spot for taxes where if you raise them past this, you will actually decrease revenue and if they are too low you will decrease revenue.

That hurts the argument right off the bat and destroys any credibility the author may have. Compare Ohio to Illinois for a better apples to apples argument.

The entire article starts with a premise that's a fabrication then compares apples to oranges.

Laffer talked about the sweet spot for taxes where if you raise them past this, you will actually decrease revenue and if they are too low you will decrease revenue.

That hurts the argument right off the bat and destroys any credibility the author may have. Compare Ohio to Illinois for a better apples to apples argument.

Dr Kynes

Well-Known Member

the "argument" was from aljazeera.Pad, that's not what the Laffer Curve theory says at all.

The entire article starts with a premise that's a fabrication then compares apples to oranges.

Laffer talked about the sweet spot for taxes where if you raise them past this, you will actually decrease revenue and if they are too low you will decrease revenue.

That hurts the argument right off the bat and destroys any credibility the author may have. Compare Ohio to Illinois for a better apples to apples argument.

you expected it to be rational?

ginwilly

Well-Known Member

Meh, aljazeera is just like the rest, wade through the muck to find substance. It's actually better than many.

When you compare California to Kansas in pretty much anything it's going to be hard to tell the whole story.

I can make the claim that since California has a top ten world economy (used to be top 5 so don't get excited) and more illegals than any other state, it's proof that illegal immigrants are why the economy is California is bigger than Minnesota.

I can even provide a graph to back up this claim if you'd like.

When you compare California to Kansas in pretty much anything it's going to be hard to tell the whole story.

I can make the claim that since California has a top ten world economy (used to be top 5 so don't get excited) and more illegals than any other state, it's proof that illegal immigrants are why the economy is California is bigger than Minnesota.

I can even provide a graph to back up this claim if you'd like.

Padawanbater2

Well-Known Member

How about Minnesota & Wisconsin?Compare Ohio to Illinois for a better apples to apples argument.

"A month after Mr. Walker’s inauguration in January 2011, he catapulted himself to the front ranks of national conservative leaders with attacks on the collective bargaining rights of Civil Service unions and sharp reductions in taxes and spending. Once Mr. Dayton teamed up with a Democratic Legislature in 2012, Minnesota adopted some of the most progressive policies in the country.

Minnesota raised taxes by $2.1 billion, the largest increase in recent state history. Democrats introduced the fourth highest income tax bracket in the country and targeted the top 1 percent of earners to pay 62 percent of the new taxes, according to the Department of Revenue."

http://www.nytimes.com/2013/11/24/opinion/sunday/right-vs-left-in-the-midwest.html?pagewanted=all&_r=0

UncleBuck

Well-Known Member

didn't the laffer curve peg that sweet spot at about 70% or so?Pad, that's not what the Laffer Curve theory says at all.

The entire article starts with a premise that's a fabrication then compares apples to oranges.

Laffer talked about the sweet spot for taxes where if you raise them past this, you will actually decrease revenue and if they are too low you will decrease revenue.

That hurts the argument right off the bat and destroys any credibility the author may have. Compare Ohio to Illinois for a better apples to apples argument.

nope , but wtf do you know.didn't the laffer curve peg that sweet spot at about 70% or so?

UncleBuck

Well-Known Member

and i'm sure an honest upstanding person like you has a valid citation for that!nope , but wtf do you know.

UncleBuck

Well-Known Member

i'm sure you spend a lot of time there!