WHODAT@THADOR

Well-Known Member

*NOTE This is going to take me several days to complete unless I just happen to get the time to power through it all.

Intro:

"Free and Fair market capitalism is the best path to prosperity"-Larry Kudlow....The good lord knows I hate Larry Kudlow.... But, he is correct in his statement....We are lucky to live in one of the few countries that allows you take control of your destiny and Capitalize on others Misfortunes...Sounds kind of sick right? Not if you knew that 70% of volumes traded across ALL exchanges belongs to the top 1%...Did you happen to know that every time there is a correction or recession the wealthy are lining there pockets with cash, while you the average working man with a simple 401k is left holding the basket? It's the greater fools theory who's gonna be the last one to buy the top and hold shares through the downturn.Now your no longer sick maybe a little pissed? The market is aware that the average American does not have time to follow his contributions,Doesn't watch CNBC, and damn sure does not understand Price to Earnings Ratios (P/E ratio) In this Article I'm going to cover basic trading strategies,Pattern recognition,Entry/Exit,Market Differences,Etc in hopes that it helps you grow your Savings, and give you a basic knowledge of Market Structure. The information I'm going to cover would cost thousands in classes or take a lot of time to research on your own. I hope this helps and Best of Luck in all your trades. BTW if you ever make 10 million dollars or something remember who showed ya how

Enjoy

WHODAT

OOOOKKKKK....So your still around huh? Well let's go over some

Basic market information that you should be aware of.

There are several Types of markets and we are going to cover them here, But for the purpose of simplicity I am not going to go into correlations.

1. Forex: These are currency pairs, the highest volumes can be found in the USD/GBP, But there are also high volume pairs out there as well.The first is your Base currency 2nd is your qoute currency. Essentially it is telling you how much of the qoute currency you have to have to buy the base currency. Currencies trades in PIP's starting at 1/100th of the penny. These markets are not very volatile and move slowly for those reasons they are a good spot to start if you attempt to day trade.

2. Futures: Under futures you will find precious metals,stocks and commodities. These trades usually require a percent of margin per contract depending on your Broker. They also ROLLOVER meaning expire UNLESS you use a continuous contract....Ex. CL 08-14 is expired CL ##-## is the continuous and is similar to owning stock. Futures pay out a predetermined amount per dollar movement.

3.Stocks:Stocks trade on Indexes such as the Dow,S&P,Nasdaq,Russell,Nyse.... This is probably the one everybody is most familiar with Stocks do not expire unless your company goes bankrupt. Also, I am going to include ETF'S in this or Exchange Traded Funds which are comprised of percents of assets put together by whoever wants to. Bet you didn't know that?

4.Options:They trade on CBOE(Chicago Board Options Exchange) Options are probably the most under utilized Hedging tool you have in your arsenal at your exposure. All you ever hear is Hedge with gold....Well what happens if Gold starts falling? Did you ever think instead I should buy a deep out-of-the-money option to protect my investment because if my stock falls it will inflate and all I am out is the commisions?Hmmm......We may cover that later. But options trade in contracts of 100 shares with an attached premium and an Expiration date which will always be the 3rd Friday of every month(Except weeklies) So, this is what you would see CSCO 25.00C 7/16/14. There is also a shorter more confusing code. The way it is displayed changes with platform. I will include an options section below as I get to it.

5. Exchanges: These are the places your instruments will trade Amex,Nyx,Nymex,comex etc. This is important because you will pay these people monthly and not all data is created equal and will have varying rates.

Okay....So you are still reading...Well, thats good....

Basic Terminology and explanations of:

Instrument: Also called Security its essentially the fancy term for whatever your trading or the "Ticker Symbol" Ex. AAPL is the instrument or also known as Apple.

Margin: A percent on a instrument you borrow from the broker to purchase the said instrument

Margin Call: When your trade has gone so far against you that the broker requires you to deposit more money

Long: I own something that is backed with cash...or a little bit is margined and I believe the price of my security will rise.

Short: I am saying the security will fall in price. Also,these shares are borrowed from other people(Brokerages) to be re bought at a lower price. The act of rebuying is called COVERING. Some shares have a DAYS TO COVER note attached which is how long they will allow you to stay short.

Call Option: Is the right to own your security at the price of purchase(premium) at a fraction of the price. Its the same as being long we believe the price is going to rise.*BE AWARE options have a thing called THETA and they lose so much value each day.....anywhere from a penny to a dollar or slightly more.

Put option: Same as Call except we are saying the price is going to go down.

Technical Definition of call/put options: Is the right but not the Obligation to Buy or Sell said security on or before the expiration date.

ETF: Exchange Traded Funds are a compilation of stocks that can be created by anybody at a certain percent of each instruments assets essentially. They are either Leveraged, double-leveraged, or triple-leveraged against each included instruments assets and derivatives. JUST MY .2 CENTS they are also in theory going to be the next cause of "ECONOMICAL RECESSION" and there are too many article's to cite on that one. I do see it that way...JMO

Correction: Is a drop no Greater then 20% from the current High of either the traded security or the market.

Bull Market: Is a market making consecutive Higher High's and Higher Low's

Bear Market: Is a market making consecutive lower low's and Lower high's and is trading below 20% from the high's

Hedge: Is a loss prevention strategy.....Ex. I buy 100 shares of GILD @ 80.00 (cost 8,000.00 + commision) to protect my investment I buy Out of the money 70.00 Put option with the amount of time I plan to be in the trade. Let's say my Put option is trading .95 by 1.00 it just cost me 100 buck to protect my investment verses buying a bar of gold? You do the math??

Right so we now understand these terms? There are plenty more but that will do for now...LOL... Then onto some meat right???

Candlestick Patterns

So,long story short Candlestick patterns were created buy this japanese guy named Homma around 18th century to keep track of rice and its prices....Simple enough??

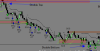

This next section will cover REVERSAL patterns and END OF MOVE patterns only there are many many more patterns out there (Each as insignificant as the one before it...JMO) If you want to know them I suggest locating the Google button and typing in Candlestick patterns I promise you will not be let down.

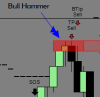

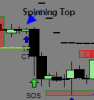

The Bullish hanging man: is a candlestick where the Bear's tried to drive through a support level only to have the session close above the open. It is almost by defintion a Price spike. It get's it's name because it looks like a stick figure with no arms.

Intro:

"Free and Fair market capitalism is the best path to prosperity"-Larry Kudlow....The good lord knows I hate Larry Kudlow.... But, he is correct in his statement....We are lucky to live in one of the few countries that allows you take control of your destiny and Capitalize on others Misfortunes...Sounds kind of sick right? Not if you knew that 70% of volumes traded across ALL exchanges belongs to the top 1%...Did you happen to know that every time there is a correction or recession the wealthy are lining there pockets with cash, while you the average working man with a simple 401k is left holding the basket? It's the greater fools theory who's gonna be the last one to buy the top and hold shares through the downturn.Now your no longer sick maybe a little pissed? The market is aware that the average American does not have time to follow his contributions,Doesn't watch CNBC, and damn sure does not understand Price to Earnings Ratios (P/E ratio) In this Article I'm going to cover basic trading strategies,Pattern recognition,Entry/Exit,Market Differences,Etc in hopes that it helps you grow your Savings, and give you a basic knowledge of Market Structure. The information I'm going to cover would cost thousands in classes or take a lot of time to research on your own. I hope this helps and Best of Luck in all your trades. BTW if you ever make 10 million dollars or something remember who showed ya how

Enjoy

WHODAT

OOOOKKKKK....So your still around huh? Well let's go over some

Basic market information that you should be aware of.

There are several Types of markets and we are going to cover them here, But for the purpose of simplicity I am not going to go into correlations.

1. Forex: These are currency pairs, the highest volumes can be found in the USD/GBP, But there are also high volume pairs out there as well.The first is your Base currency 2nd is your qoute currency. Essentially it is telling you how much of the qoute currency you have to have to buy the base currency. Currencies trades in PIP's starting at 1/100th of the penny. These markets are not very volatile and move slowly for those reasons they are a good spot to start if you attempt to day trade.

2. Futures: Under futures you will find precious metals,stocks and commodities. These trades usually require a percent of margin per contract depending on your Broker. They also ROLLOVER meaning expire UNLESS you use a continuous contract....Ex. CL 08-14 is expired CL ##-## is the continuous and is similar to owning stock. Futures pay out a predetermined amount per dollar movement.

3.Stocks:Stocks trade on Indexes such as the Dow,S&P,Nasdaq,Russell,Nyse.... This is probably the one everybody is most familiar with Stocks do not expire unless your company goes bankrupt. Also, I am going to include ETF'S in this or Exchange Traded Funds which are comprised of percents of assets put together by whoever wants to. Bet you didn't know that?

4.Options:They trade on CBOE(Chicago Board Options Exchange) Options are probably the most under utilized Hedging tool you have in your arsenal at your exposure. All you ever hear is Hedge with gold....Well what happens if Gold starts falling? Did you ever think instead I should buy a deep out-of-the-money option to protect my investment because if my stock falls it will inflate and all I am out is the commisions?Hmmm......We may cover that later. But options trade in contracts of 100 shares with an attached premium and an Expiration date which will always be the 3rd Friday of every month(Except weeklies) So, this is what you would see CSCO 25.00C 7/16/14. There is also a shorter more confusing code. The way it is displayed changes with platform. I will include an options section below as I get to it.

5. Exchanges: These are the places your instruments will trade Amex,Nyx,Nymex,comex etc. This is important because you will pay these people monthly and not all data is created equal and will have varying rates.

Okay....So you are still reading...Well, thats good....

Basic Terminology and explanations of:

Instrument: Also called Security its essentially the fancy term for whatever your trading or the "Ticker Symbol" Ex. AAPL is the instrument or also known as Apple.

Margin: A percent on a instrument you borrow from the broker to purchase the said instrument

Margin Call: When your trade has gone so far against you that the broker requires you to deposit more money

Long: I own something that is backed with cash...or a little bit is margined and I believe the price of my security will rise.

Short: I am saying the security will fall in price. Also,these shares are borrowed from other people(Brokerages) to be re bought at a lower price. The act of rebuying is called COVERING. Some shares have a DAYS TO COVER note attached which is how long they will allow you to stay short.

Call Option: Is the right to own your security at the price of purchase(premium) at a fraction of the price. Its the same as being long we believe the price is going to rise.*BE AWARE options have a thing called THETA and they lose so much value each day.....anywhere from a penny to a dollar or slightly more.

Put option: Same as Call except we are saying the price is going to go down.

Technical Definition of call/put options: Is the right but not the Obligation to Buy or Sell said security on or before the expiration date.

ETF: Exchange Traded Funds are a compilation of stocks that can be created by anybody at a certain percent of each instruments assets essentially. They are either Leveraged, double-leveraged, or triple-leveraged against each included instruments assets and derivatives. JUST MY .2 CENTS they are also in theory going to be the next cause of "ECONOMICAL RECESSION" and there are too many article's to cite on that one. I do see it that way...JMO

Correction: Is a drop no Greater then 20% from the current High of either the traded security or the market.

Bull Market: Is a market making consecutive Higher High's and Higher Low's

Bear Market: Is a market making consecutive lower low's and Lower high's and is trading below 20% from the high's

Hedge: Is a loss prevention strategy.....Ex. I buy 100 shares of GILD @ 80.00 (cost 8,000.00 + commision) to protect my investment I buy Out of the money 70.00 Put option with the amount of time I plan to be in the trade. Let's say my Put option is trading .95 by 1.00 it just cost me 100 buck to protect my investment verses buying a bar of gold? You do the math??

Right so we now understand these terms? There are plenty more but that will do for now...LOL... Then onto some meat right???

Candlestick Patterns

So,long story short Candlestick patterns were created buy this japanese guy named Homma around 18th century to keep track of rice and its prices....Simple enough??

This next section will cover REVERSAL patterns and END OF MOVE patterns only there are many many more patterns out there (Each as insignificant as the one before it...JMO) If you want to know them I suggest locating the Google button and typing in Candlestick patterns I promise you will not be let down.

The Bullish hanging man: is a candlestick where the Bear's tried to drive through a support level only to have the session close above the open. It is almost by defintion a Price spike. It get's it's name because it looks like a stick figure with no arms.

Last edited: