Who will be better at getting America out of debt, Trump or Hillary?

- Thread starter DavidKratos92

- Start date

twostrokenut

Well-Known Member

Get the bullhorn out, call all your backup; it's not going to help your simple delusion that appreciation has made you any money unless you sell. Imaging you bought your little slice of the suburban Denver skyline in 2006. It's like the copper, silver and gold coins you like to make fun of so much, you're in it for the short term and I wish you well, even though history and facts disagree with you."Libertarians are just Republicans who have lost touch with any shred of reality." - @Fogdog

UncleBuck

Well-Known Member

in that case, i'd have $110,000 worth of equity.Imaging you bought your little slice of the suburban Denver skyline in 2006.

how much value has your trailer lost in 10 years on the contrary?

twostrokenut

Well-Known Member

IDK, tell me about it since you seem very familiar with it.But what about space rent?

Fogdog

Well-Known Member

Aren't you the sock fished out of swamp scum that kept asking what the carbon dioxide content of the earth's atmosphere 250 million years ago when the discussion concerned current climate issues? Why were you so concerned about that?You realize you can donate to the IRS as much as you like right? Why not be respectable and practice what you preach and even the gap.

NLXSK1

Well-Known Member

If you are paying any percentage rate on your mortgage by the time you add up all of the interest payments, taxes, insurance and maintenance fees you are not saving any money at all. In fact, most people pay far more into their home than they get out in appreciation.Get the bullhorn out, call all your backup; it's not going to help your simple delusion that appreciation has made you any money unless you sell. Imaging you bought your little slice of the suburban Denver skyline in 2006. It's like the copper, silver and gold coins you like to make fun of so much, you're in it for the short term and I wish you well, even though history and facts disagree with you.

But most people are not investors.

UncleBuck

Well-Known Member

you inherited your house from your now deceased parents.If you are paying any percentage rate on your mortgage by the time you add up all of the interest payments, taxes, insurance and maintenance fees you are not saving any money at all. In fact, most people pay far more into their home than they get out in appreciation.

But most people are not investors.

twostrokenut

Well-Known Member

Tell us again how much money you are saving by having a mortgage vs paying it off again, its literally the dumbest shit anyone has said on these boards I can remember.in that case, i'd have $110,000 worth of equity.

how much value has your trailer lost in 10 years on the contrary?

UncleBuck

Well-Known Member

i've already run through the math regarding your $0.00 ROI on ~$100,000 worth of investments into trailers over a lifetime, versus the ~$600,000 ROI i will get on 30 years worth of mortgage payments worth ~$360,000.Tell us again how much money you are saving by having a mortgage vs paying it off again, its literally the dumbest shit anyone has said on these boards I can remember.

deal with it, trailer trash.

twostrokenut

Well-Known Member

You have failed to substantiate your claim of wealth. Sorry, noone buys it. You are quite honest about the cost of your median, average priced home which you couldn't even come up with 20% down for to avoid pmi. For your age of a person that's kind of sad.i've already run through the math regarding your $0.00 ROI on ~$100,000 worth of investments into trailers over a lifetime, versus the ~$600,000 ROI i will get on 30 years worth of mortgage payments worth ~$360,000.

deal with it, trailer trash.

Tell us again how having a mortgage is saving you more money than paying it off early with your current wealth.

UncleBuck

Well-Known Member

jesusfuck, you sure don't understand much.You have failed to substantiate your claim of wealth. Sorry, noone buys it. You are quite honest about the cost of your median, average priced home which you couldn't even come up with 20% down for to avoid pmi. For your age of a person that's kind of sad.

Tell us again how having a mortgage is saving you more money than paying it off early with your current wealth.

we were a little shy of the approximately $50,000 we would've needed. oh well.

tell us about how wise it would be to cash out and pay taxes on $200,000 worth of stocks and other assets to get rid of a mortgage payment, when just sitting on that $200k will make us far more money over 30 years than paying off the house would.

trailer dweller.

twostrokenut

Well-Known Member

Jesus you really are a dumb ass aren't you. What is your household bring home in a year? Send an extra 500 to principle every month for the rest of the year and watch how fast your bank offers you to take a break from your mortgage and take a vacation.jesusfuck, you sure don't understand much.

we were a little shy of the approximately $50,000 we would've needed. oh well.

tell us about how wise it would be to cash out and pay taxes on $200,000 worth of stocks and other assets to get rid of a mortgage payment, when just sitting on that $200k will make us far more money over 30 years than paying off the house would.

trailer dweller.

UncleBuck

Well-Known Member

should i do the calculations for you on what $200,000 would make over 28 years conservatively invested?Jesus you really are a dumb ass aren't you. What is your household bring home in a year? Send an extra 500 to principle every month for the rest of the year and watch how fast your bank offers you to take a break from your mortgage and take a vacation.

i bet all you are thinking about right now is how many pennies you could buy for $200k.

twostrokenut

Well-Known Member

If cashing out 200k in your household puts you in the 300k tax bracket, which it would going by the median standard you are adhering to, then your taxes are 33% . Still saves you 50k instantly which coincidentally is about the amount you were short to avoid PMI.should i do the calculations for you on what $200,000 would make over 28 years conservatively invested?

i bet all you are thinking about right now is how many pennies you could buy for $200k.

But now you are free to save your yearly earnings for the next two years (around 200k) and invest foolishly in what ever stocks or what not you have been dabbling in. Unless you are claiming your 200k investment would double in two years, which it won't.

So ya lets see some more math, like the estimated value of your home when you're 60, that was a good laugh. Even if it were a billion trillion so to would be all the homes in your town. You would have to move to an area with a lower cost of living to take advantage of that and those places are disappearing as I type this. You won't make it.

Last edited:

UncleBuck

Well-Known Member

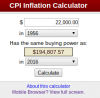

60 years ago, the average home price was $22,000. my estimate was beyond conservative.So ya lets see some more math, like the estimated value of your home when you're 60, that was a good laugh.

don't be so angry just because i am pointing out that your trailer is not an investment and you are simply throwing money away rather than investing it and watching it grow.

twostrokenut

Well-Known Member

I've invested in a stick built brick veneer. Difference in you and I is I am not relying on home equity and stock market to carry my retirement. I am not even counting on social security. Get over it.60 years ago, the average home price was $22,000. my estimate was beyond conservative.

don't be so angry just because i am pointing out that your trailer is not an investment and you are simply throwing money away rather than investing it and watching it grow.

UncleBuck

Well-Known Member

my wife wants to know what you do with the pennies, since it is a federal crime with a 5 year minimum sentence to deface united states currency.I've invested in a stick built brick veneer. Difference in you and I is I am not relying on home equity and stock market to carry my retirement. I am not even counting on social security. Get over it.

twostrokenut

Well-Known Member

Also, in 1956 dollars were silver. Your $22k figure is worth $383k in today's terms. That means today is actually below the average of 60 years ago.60 years ago, the average home price was $22,000. my estimate was beyond conservative.

don't be so angry just because i am pointing out that your trailer is not an investment and you are simply throwing money away rather than investing it and watching it grow.