WHODAT@THADOR

Well-Known Member

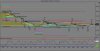

My reason to put this up is just this to put it up and share how im trading Why i think what im thinking about on a specific Trade...... Up above is a copy of my GC 08-14 weekly chart ......I am currently bearish until shown otherwise and believe gold to be in a position to break out up or down.....Either way I will not add to my short position unless the symetrical triangle is broken or the bulls attempt to drive through the PI retracement .314% ....But I see well calculated risk/reward here either way..There are two legs of this down trend both coming into the .786 extensions.......So IF the triangle fails it is very likely to replicate our first leg ....Lets call him A and the turqouise B....... our B leg comes in at the 944.00 range.......if I wait till my confirmation buy 1 contract of gold it replicates thats a 350.00 move.......my one 1319.00 bar is now worth 37319.00....If I wait untill I have a confirmed break out to the upside I cover my short position and then go long looking for a run to the 50% or ,618 Retracement which both come in 1488.00-1561.00 Thus earning me 200.00 bux a contract or 20,000 on my 1319.00 investment.......Entries will be made with stops upon confirmation and will trail with parablics and fibs....Below is a daily showing the two other legs I measued for fib ratios better....This is all based upon technicals no fundamentals ....Fundamentals constantly shift and can be perceived falsely and tied into to much emotions.....But if I was goin to even glance at it that way it would be with market correlation's which are that we are in a BULL market until shown other wise use pullbacks as buying oppurtunities and sell gold...be wise in your trading.......Anybody else got any to share?

My reason to put this up is just this to put it up and share how im trading Why i think what im thinking about on a specific Trade...... Up above is a copy of my GC 08-14 weekly chart ......I am currently bearish until shown otherwise and believe gold to be in a position to break out up or down.....Either way I will not add to my short position unless the symetrical triangle is broken or the bulls attempt to drive through the PI retracement .314% ....But I see well calculated risk/reward here either way..There are two legs of this down trend both coming into the .786 extensions.......So IF the triangle fails it is very likely to replicate our first leg ....Lets call him A and the turqouise B....... our B leg comes in at the 944.00 range.......if I wait till my confirmation buy 1 contract of gold it replicates thats a 350.00 move.......my one 1319.00 bar is now worth 37319.00....If I wait untill I have a confirmed break out to the upside I cover my short position and then go long looking for a run to the 50% or ,618 Retracement which both come in 1488.00-1561.00 Thus earning me 200.00 bux a contract or 20,000 on my 1319.00 investment.......Entries will be made with stops upon confirmation and will trail with parablics and fibs....Below is a daily showing the two other legs I measued for fib ratios better....This is all based upon technicals no fundamentals ....Fundamentals constantly shift and can be perceived falsely and tied into to much emotions.....But if I was goin to even glance at it that way it would be with market correlation's which are that we are in a BULL market until shown other wise use pullbacks as buying oppurtunities and sell gold...be wise in your trading.......Anybody else got any to share?

WHODAT