ViRedd

New Member

Sub-Prime Politicians

By Thomas Sowell

Wednesday, August 8, 2007

Amid all the hand-wringing and finger-pointing as housing markets collapse, mortgage foreclosures skyrocket, and financial markets panic, there is very little attention being paid to the fundamental economic and political decisions that led to this mess.

The growth in risky "sub-prime" mortgage loans by people buying homes they could not really afford has been a key factor in the collapse of housing markets, when the risks caught up with both borrowers and lenders.

But why were home buyers suddenly taking out so many risky loans and lenders suddenly arranging so much "creative" financing for these borrowers?

One clue is the concentration of such risky behavior in particular places and times.

Interest-only mortgages, where nothing is being paid on the principal for the first few years, enable many people to get started on buying a home with lower mortgage payments at the outset.

But of course it is only a matter of time before the mortgage payments go up and, unless their income has gone up enough in the meantime for them to be able to afford the new and higher payments, such borrowers can end up losing their homes.

Such risky mortgage loans were rare just a few years ago. As of 2002, fewer than 10 percent of the new mortgages in the United States were of this type. But, by 2006, 31 percent of all new mortgages were of this "creative" or risky type.

In the San Francisco Bay Area, 66 percent of the new mortgages were of this type.

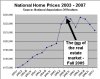

Why this difference in times and places? Because housing prices were skyrocketing in some places and times, so that people of modest incomes had to go out on a limb to buy a house, if they expected to buy a house at all.

But why were housing prices going up so fast, in the first place? A number of studies of communities across the United States and in countries overseas turned up the same conclusion: Government restrictions on building.

While many other factors can be involved -- rising incomes, population growth, construction costs -- a scrutiny of the times and places where housing prices doubled, tripled, or quadrupled within a decade shows that restrictions on building have been the key.

Attractive and heady phrases like "open space," "smart growth" and the like have accompanied land use restrictions that made the cost of land rise in many places to the point where it greatly exceeded the cost of the homes built on the land.

In places that resisted this political rhetoric, home prices remained reasonable, despite rising incomes and population growth.

Construction costs were seldom a major factor, for there was relatively little construction in places with severe building restrictions and skyrocketing home prices.

In short, government has been the principal factor preventing the "affordable housing" that politicians talk about so much.

Politicians have also been a key factor behind pushing lenders to lend to borrowers with lower prospects of being able to repay their loans.

The Community Reinvestment Act lets politicians pressure lenders to lend to people they might not lend to otherwise -- and the same politicians are quick to cry "exploitation" when the interest charged to high-risk borrowers reflects that risk.

The huge losses of sub-prime lenders, some of whom have gone bankrupt, demonstrate again the consequences of letting politicians try to micro-manage the economy.

Yet with all the finger-pointing in the media and in government, seldom is a finger pointed at the politicians at local, state and national levels who have played a key role in setting up the conditions that led to financial disasters for individual home buyers and for those who lent to them.

While financial markets are painfully adjusting and both lenders and borrowers are becoming less likely to take on so much risky "creative" financing in the future, politicians show no sign of changing.

Why should they, when they have largely escaped blame for the disasters that their policies fostered?

Thomas Sowell is a senior fellow at the Hoover Institute and author of Basic Economics: A Citizen's Guide to the Economy.

By Thomas Sowell

Wednesday, August 8, 2007

Amid all the hand-wringing and finger-pointing as housing markets collapse, mortgage foreclosures skyrocket, and financial markets panic, there is very little attention being paid to the fundamental economic and political decisions that led to this mess.

The growth in risky "sub-prime" mortgage loans by people buying homes they could not really afford has been a key factor in the collapse of housing markets, when the risks caught up with both borrowers and lenders.

But why were home buyers suddenly taking out so many risky loans and lenders suddenly arranging so much "creative" financing for these borrowers?

One clue is the concentration of such risky behavior in particular places and times.

Interest-only mortgages, where nothing is being paid on the principal for the first few years, enable many people to get started on buying a home with lower mortgage payments at the outset.

But of course it is only a matter of time before the mortgage payments go up and, unless their income has gone up enough in the meantime for them to be able to afford the new and higher payments, such borrowers can end up losing their homes.

Such risky mortgage loans were rare just a few years ago. As of 2002, fewer than 10 percent of the new mortgages in the United States were of this type. But, by 2006, 31 percent of all new mortgages were of this "creative" or risky type.

In the San Francisco Bay Area, 66 percent of the new mortgages were of this type.

Why this difference in times and places? Because housing prices were skyrocketing in some places and times, so that people of modest incomes had to go out on a limb to buy a house, if they expected to buy a house at all.

But why were housing prices going up so fast, in the first place? A number of studies of communities across the United States and in countries overseas turned up the same conclusion: Government restrictions on building.

While many other factors can be involved -- rising incomes, population growth, construction costs -- a scrutiny of the times and places where housing prices doubled, tripled, or quadrupled within a decade shows that restrictions on building have been the key.

Attractive and heady phrases like "open space," "smart growth" and the like have accompanied land use restrictions that made the cost of land rise in many places to the point where it greatly exceeded the cost of the homes built on the land.

In places that resisted this political rhetoric, home prices remained reasonable, despite rising incomes and population growth.

Construction costs were seldom a major factor, for there was relatively little construction in places with severe building restrictions and skyrocketing home prices.

In short, government has been the principal factor preventing the "affordable housing" that politicians talk about so much.

Politicians have also been a key factor behind pushing lenders to lend to borrowers with lower prospects of being able to repay their loans.

The Community Reinvestment Act lets politicians pressure lenders to lend to people they might not lend to otherwise -- and the same politicians are quick to cry "exploitation" when the interest charged to high-risk borrowers reflects that risk.

The huge losses of sub-prime lenders, some of whom have gone bankrupt, demonstrate again the consequences of letting politicians try to micro-manage the economy.

Yet with all the finger-pointing in the media and in government, seldom is a finger pointed at the politicians at local, state and national levels who have played a key role in setting up the conditions that led to financial disasters for individual home buyers and for those who lent to them.

While financial markets are painfully adjusting and both lenders and borrowers are becoming less likely to take on so much risky "creative" financing in the future, politicians show no sign of changing.

Why should they, when they have largely escaped blame for the disasters that their policies fostered?

Thomas Sowell is a senior fellow at the Hoover Institute and author of Basic Economics: A Citizen's Guide to the Economy.