So You Want to get a Growers license, Let's do the Math

- Thread starter William Wonder

- Start date

Raoul Duke1

Member

I have seen the inside of a Federal prison and I would rather risk that then live a miserable life barely getting by that said I do believe we can always better ourselves and do not have to do either orYou my friend have not seen the inside of a federal prison. Just sayin. Our prisons are really rough. I would not wish that on anyone for growing or tax evasion.

Raoul Duke1

Member

These people hate the free market and capitalism they are all a bunch of progressive turds who love big government and tons of regulation if they wanted it to work they would have sensible regulations that protect the consumer while allowing business to make money in turn paying more taxes and employing more peopleNow I hear Washington wants to eliminate medical home grows. I suppose the point is sort of moot considering when its legal Jan. 1, when everyone can grow 6 plants is it, indoors? This is the state attempting to monopolize the market. It's like instead of allowing home brewers to brew their own beer and sell it, they want you to buy it in state taxed liquor store instead. These legal states just can't figure it all out, every scheme gives a large amount of booty to the state. Why should the majority of the retail price of an item go to taxes? MJ states need to fight against this. Pot taxed at a high rate is the same as prohibition, it allows a black market and keeps prices high.

TheyCallMe2K

Active Member

I think you guys are missing a huge part. Washington has two parts; medical and recreational. Medical can grow 15. Recreation cant grow anything (as of now) if i remember correctly.

Howard Stern

Well-Known Member

They should change the title from "lets do the math" to Let's do the METH!

TwooDeff425

Well-Known Member

This is what the people "voted" for, isn't it?

Howard Stern

Well-Known Member

Stupid people voted yes on 502! But Hey we will see and hear them all crying when oz's skyrocet! Tax tax tax! LOL have fun! OH and register your MMJ grow room and put cameras in there so the police anyone with a laptop can look right into your grow room! Have fun! Man with all these taxes, NEW regulations, permitsThis is what the people "voted" for, isn't it?

The price of weed should plummet because people with permits will just be able to grow more......................... I guess we will all be dancing in the streets with Oz's of top shelf weed that the LCB and the State of Wa will keep at a good price for what $150 or maybe even $100??????? Man I can't wait for the happy day of free weed and trillions of tax dollars to come rolling in! LMAO

blackrecluse

Active Member

just keep growing.

This is not correct. The 25% does not add up to 75%. I personally think the taxes are too high but we need to understand them properly if we are going to make intelligent arguments against them. I wonder how many people actually read the bill? page 40 section 27 covers the taxes.The government wants 25% of the retail value of everything you grow. Let's say an Oz goes for $250 retail in the shops. This is where CO prices are at. The government wants 25% of the retail value of your oz which is 62.50. It also wants 25% of the retail value from the processor and 25% of the retail value from the retailer. The government wants 75% of the $250 oz. That leaves $62.50 per oz that must be shared by the grower, processor and retailer. So the grower ends up with about $21 per oz as does the processor and retailer, assuming the margins are cut equally. Now factor in rent or mortgage, property taxes, lights and equipment, utilities, security, grow media and annual license fees and employees and it's going to be real hard to make a profit and if you do, you must pay income tax on that. The mafia isn't even as greedy as the government. The mafia will allow you to make a profit so they can profit on you. Is this what you want? It makes more sense to grow your own 15 plants, make hash out of it and mail it to your cousins in Iowa or Minnesota. The big winners in all this, if there are any, are going to be the processors because of the low overhead, no lights or electricity, no retail space.

FOR EXAMPLE this is my understanding of what it says:

Producer sells to processor for $5 a gram, WA gets $1.25 in 502 taxes per gram from producer

Processor then sells to retailer for $9 a gram, WA gets $2.25 in 502 taxes per gram from processor

Retailer now sells to customer or $15 a gram, WA gets $3.75 in 502 taxes per gram from retailer

I have also heard that just profits is getting the 25% tax and I have not been able to 100% clarify this yet. ie processor would pay $1 a gram, retailer $1.5 a gram.

freeflow

Member

the recommended sale price for a producer to processor is $3 a gram, processor to retail is $6 a gram and retail to public $12.5 a gram. That anyways is what they have stated on the recommendations, of course some will seek more while others may try and be the walmart retail store and sell for less and make money on more purchases.

That being said:

So lets say each phase is taxed based on the amounts recommended:

Producer: $3 @ 25% tax = .75 per gram so a producer can sell to a processor at $2.25 per gram (profit)

Producer/processor tax same at 25% so $6 x .25% = $1.50 so a producer/processor sales to retail store at $4.50 per gram (profit)

Processor: sells to retail at $6 per gram tax of .25% = $1.50 so $4.50 after tax subtract the $3 per gram paid = $1.50 per gram profit

Retail sells at $12.50 per gram tax of 25% = $3.13 so $9.37 after tax subtract the $6 per gram = $3.37 per gram profit

So doing the math and adding all up: $12.50 public cost, tax:$5.38 per gram on sale between each classes total tax of 43% from seed to sell.

but if u have producer/processor cost is: $12.50 public cost, tax: $4.63 per gram on sales between only 2 businesses for a total tax of 37% from seed to sell.

Believe those are the numbers, feel free to correct them if wrong.

Based on the profit margin most profit is:

Producer/processor $4.50 per gram

Retail $3.37 per gram

Producer $2.25 per gram

Processor $1.50

Now if business minded individuals are behind the tax scheduling then it would be based on profit costs example, $3 for producer, $3 for processor or $6 for producer/processor and $6.5 for stores

same scenario as above but with logical thinking behind the curtains price would be more like this:

Producer: $3 @ 25% tax = .75 per gram so a producer can sell to a processor at $2.25 per gram (profit)

Producer/processor tax same at 25% so $6 x .25% = $1.50 so a producer/processor sales to retail store at $4.50 per gram (profit)

Processor: $3 @ 25% tax = .75 per gram so a producer can sell to a processor at $2.25 per gram (profit)

Retail: $6.5 @ 25% tax = $1.63 per gram total of $4.87 per gram (profit)

So doing the math and adding all up: $12.50 public cost, tax:$3.13 per gram on sale between each classes total tax of 25% from seed to sell.

but if u have producer/processor cost is: $12.50 public cost, tax: $3.13 per gram on sales between only 2 businesses for a total tax of 25% from seed to sell.

Think I ran my numbers right

Based on the profit margin most profit is:

Retail $4.87 per gram

Producer/processor $4.50 per gram

Producer $2.25 per gram

Processor $2.25 per gram

That being said:

So lets say each phase is taxed based on the amounts recommended:

Producer: $3 @ 25% tax = .75 per gram so a producer can sell to a processor at $2.25 per gram (profit)

Producer/processor tax same at 25% so $6 x .25% = $1.50 so a producer/processor sales to retail store at $4.50 per gram (profit)

Processor: sells to retail at $6 per gram tax of .25% = $1.50 so $4.50 after tax subtract the $3 per gram paid = $1.50 per gram profit

Retail sells at $12.50 per gram tax of 25% = $3.13 so $9.37 after tax subtract the $6 per gram = $3.37 per gram profit

So doing the math and adding all up: $12.50 public cost, tax:$5.38 per gram on sale between each classes total tax of 43% from seed to sell.

but if u have producer/processor cost is: $12.50 public cost, tax: $4.63 per gram on sales between only 2 businesses for a total tax of 37% from seed to sell.

Believe those are the numbers, feel free to correct them if wrong.

Based on the profit margin most profit is:

Producer/processor $4.50 per gram

Retail $3.37 per gram

Producer $2.25 per gram

Processor $1.50

Now if business minded individuals are behind the tax scheduling then it would be based on profit costs example, $3 for producer, $3 for processor or $6 for producer/processor and $6.5 for stores

same scenario as above but with logical thinking behind the curtains price would be more like this:

Producer: $3 @ 25% tax = .75 per gram so a producer can sell to a processor at $2.25 per gram (profit)

Producer/processor tax same at 25% so $6 x .25% = $1.50 so a producer/processor sales to retail store at $4.50 per gram (profit)

Processor: $3 @ 25% tax = .75 per gram so a producer can sell to a processor at $2.25 per gram (profit)

Retail: $6.5 @ 25% tax = $1.63 per gram total of $4.87 per gram (profit)

So doing the math and adding all up: $12.50 public cost, tax:$3.13 per gram on sale between each classes total tax of 25% from seed to sell.

but if u have producer/processor cost is: $12.50 public cost, tax: $3.13 per gram on sales between only 2 businesses for a total tax of 25% from seed to sell.

Think I ran my numbers right

Based on the profit margin most profit is:

Retail $4.87 per gram

Producer/processor $4.50 per gram

Producer $2.25 per gram

Processor $2.25 per gram

colonuggs

Well-Known Member

thats just state taxes...... what about FederallyThis is not correct. The 25% does not add up to 75%. I personally think the taxes are too high but we need to understand them properly if we are going to make intelligent arguments against them. I wonder how many people actually read the bill? page 40 section 27 covers the taxes.

FOR EXAMPLE this is my understanding of what it says:

Producer sells to processor for $5 a gram, WA gets $1.25 in 502 taxes per gram from producer

Processor then sells to retailer for $9 a gram, WA gets $2.25 in 502 taxes per gram from processor

Retailer now sells to customer or $15 a gram, WA gets $3.75 in 502 taxes per gram from retailer

I have also heard that just profits is getting the 25% tax and I have not been able to 100% clarify this yet. ie processor would pay $1 a gram, retailer $1.5 a gram.

So if I sell a oz to the processor for $125 ..... $25 or 25% goes state taxes... I make $100 a oz ....minus bills and Federal taxes

Processor sells the oz he bought for $125... gets $250 a oz... he makes $125 and $25 or 25% goes to taxes

Retailer sells for $400 a oz he pays 25% 502 taxes.... plus collects the state sales tax of 9%

What I heard is we can hold both the growing and processing licenses and be taxed 1 time @ 25 %

FrozenChozen

Well-Known Member

this scares me for what is happening in Alaska right now.... current legislation is moving towards legalization; but currently it is LEGAL to grow up to 24 plants with 6 in flower and 1 oz of dried medication of hand (Ravin v. State Of Alaska ~1997).... most people here in ak have never read the fine print though, it would be a travesty to have this BS happen in my wonderful Alaska.... I may not move down south after all...

colonuggs

Well-Known Member

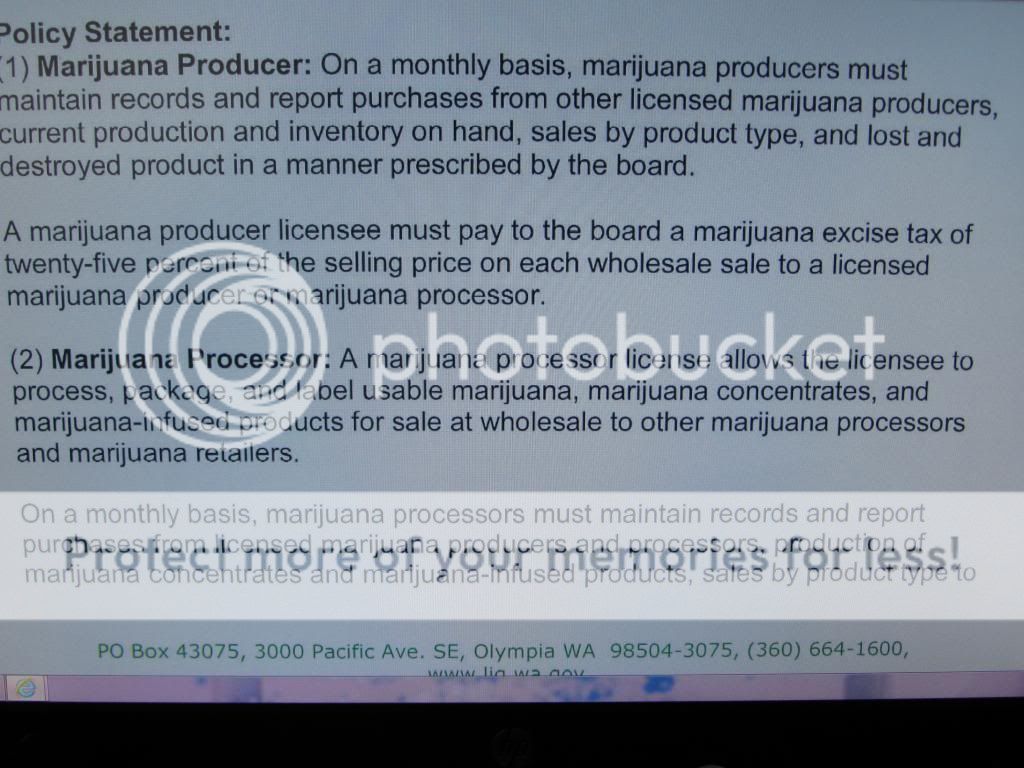

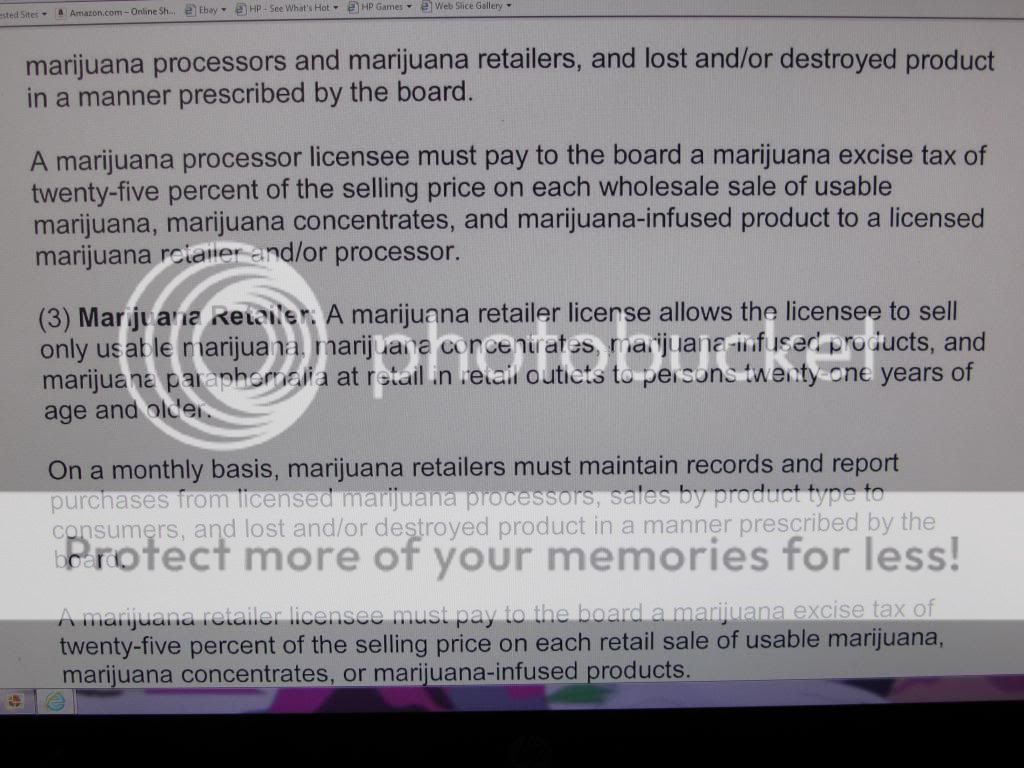

Read it and weep.....they taxin they shit out of it...25% each levelJust wait till its in writing as the language will be very detailed and scrutinized.

25% wholesaler to wholesaler.....NICE... 25% wholesaler to retailer... 25% Retailer to public.. plus 9% State sales

http://www.liq.wa.gov/publications/board/Interim Policies/BIP-09-2014 Interim-Policy-for-Marijuana-Processor-and-Retailer-Licenses.pdf

Last edited:

Milovan

Well-Known Member

Milovan

Well-Known Member

SnapsProvolone

Well-Known Member

sounds like time to improve your Colorado sources.my bro grows in Colo he's getting $2800 a lb...... same bud in Wa Im getting 2400

beanzz

Well-Known Member

Permits and regulations to grow weed, it's adorable.

I've been growing weed since I was 17 living in Florida, I'm 33 now. I've never had a permit or a license to grow my plants and somehow my plants always turn out just great without the help of nanny, dare I say they turn out great in spite of nanny.

I've been growing weed since I was 17 living in Florida, I'm 33 now. I've never had a permit or a license to grow my plants and somehow my plants always turn out just great without the help of nanny, dare I say they turn out great in spite of nanny.

colonuggs

Well-Known Member

Its all good to us.... we sell 20 lbs a wack... split 56K every 3 months..CASHsounds like time to improve your Colorado sources.

Funny part is .....none of it stays in colo

SnapsProvolone

Well-Known Member

Brilliant, not sure what to say. Trafficking is probably the most frowned upon practice in legal states.Its all good to us.... we sell 20 lbs a wack... split 56K every 3 months..CASH

Funny part is .....none of it stays in colo

to the government's attempted takeover & taxation

to the government's attempted takeover & taxation