ritish Columbia’s director of civil forfeiture is taking action to confiscate properties and bank accounts associated with a fraudulent Vancouver financial company, which received million in tax rebates under the former BC Liberal government.

The director is alleging that proceeds from illegal activities committed by PacNet Services Ltd were used to purchase and maintain those assets.

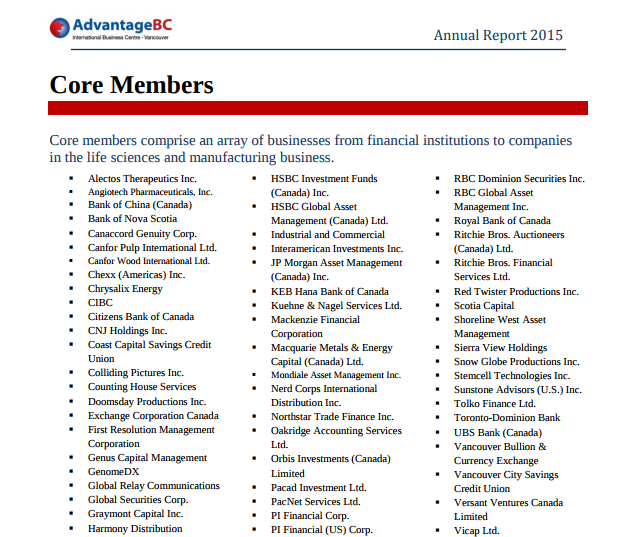

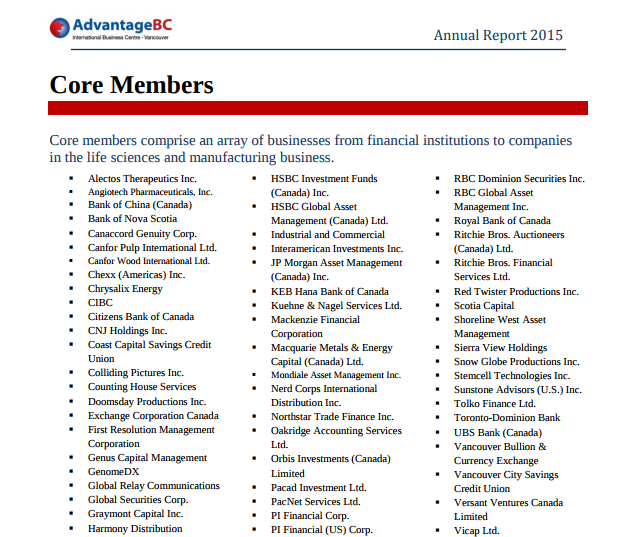

PacNet and its subsidiary Chexx Inc were core members of the AdvantageBC program, which entitled them to a tax refund of up to 100 per cent of their corporate income taxes at a cost of $140 million to the province[1].

US Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated the the corporations as a significant transnational criminal organization and seized their bank accounts last fall on the grounds that the companies have a lengthy history of money laundering by knowingly processing payments on behalf of a wide range of mail fraud schemes that target victims in the United States and throughout the world[2].

“PacNet has knowingly facilitated the fraudulent activities of its customers for many years, and today’s designations are aimed at shielding Americans and the nation’s financial system from the large-scale, illicit money flows that are generated by these scams against vulnerable individuals,” John E. Smith, OFAC Acting Director said. “Treasury will continue to use its authorities to respond to the evolving nature of transnational organized crime.”

PacNet, with operations in Canada, Ireland, and the United Kingdom, and subsidiaries or affiliates in 15 other countries, is accused of knowingly processing payments relating to fraudulent solicitation schemes, resulting in the loss of millions of dollars to US consumers.

BC Liberals received $5.8 million worth of donations from members of AdvantageBC, which is headed by former premier Christy Clark’s ex-campaign chair, who is a former BC finance minister responsible for expanding the program’s tax incentives.

While the tax deductions were offered by the Ministry of Finance under International Business Activity Program, the International Business Activity Act passed under former BC Liberal Premier Gordon Campell requires corporations to first join the not-for-profit AdvantageBC to apply for the deductions.

BC NDP came to power on a promise to crackdown on such shady schemes that the BC Liberals ran.

“Every day, it’s getting harder and more expensive to live in BC, and the only people getting ahead are Christy Clark and her rich friends,” the current BC Attorney General David Eby told voters during the campaign. “British Columbians deserve to know how much of their hard-earned tax dollars Christy Clark has secretly handed to rich donors.”

True to their words, the NDP promptly shut down the International Business Activity Program after coming into power, despite best efforts by the opposition to delay its demise[3].

[Photo: BC Liberal Leader Andrew Wilkinson attending an AdvantageBC event. Credit: Advantage BC]

This one stuck out right away lol

Canaccord Genuity

The director is alleging that proceeds from illegal activities committed by PacNet Services Ltd were used to purchase and maintain those assets.

PacNet and its subsidiary Chexx Inc were core members of the AdvantageBC program, which entitled them to a tax refund of up to 100 per cent of their corporate income taxes at a cost of $140 million to the province[1].

US Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated the the corporations as a significant transnational criminal organization and seized their bank accounts last fall on the grounds that the companies have a lengthy history of money laundering by knowingly processing payments on behalf of a wide range of mail fraud schemes that target victims in the United States and throughout the world[2].

“PacNet has knowingly facilitated the fraudulent activities of its customers for many years, and today’s designations are aimed at shielding Americans and the nation’s financial system from the large-scale, illicit money flows that are generated by these scams against vulnerable individuals,” John E. Smith, OFAC Acting Director said. “Treasury will continue to use its authorities to respond to the evolving nature of transnational organized crime.”

PacNet, with operations in Canada, Ireland, and the United Kingdom, and subsidiaries or affiliates in 15 other countries, is accused of knowingly processing payments relating to fraudulent solicitation schemes, resulting in the loss of millions of dollars to US consumers.

BC Liberals received $5.8 million worth of donations from members of AdvantageBC, which is headed by former premier Christy Clark’s ex-campaign chair, who is a former BC finance minister responsible for expanding the program’s tax incentives.

While the tax deductions were offered by the Ministry of Finance under International Business Activity Program, the International Business Activity Act passed under former BC Liberal Premier Gordon Campell requires corporations to first join the not-for-profit AdvantageBC to apply for the deductions.

BC NDP came to power on a promise to crackdown on such shady schemes that the BC Liberals ran.

“Every day, it’s getting harder and more expensive to live in BC, and the only people getting ahead are Christy Clark and her rich friends,” the current BC Attorney General David Eby told voters during the campaign. “British Columbians deserve to know how much of their hard-earned tax dollars Christy Clark has secretly handed to rich donors.”

True to their words, the NDP promptly shut down the International Business Activity Program after coming into power, despite best efforts by the opposition to delay its demise[3].

[Photo: BC Liberal Leader Andrew Wilkinson attending an AdvantageBC event. Credit: Advantage BC]

This one stuck out right away lol

Canaccord Genuity